If you’ve recently made the switch to Mac, you might be disappointed to know that Microsoft Money is not available for Mac. Microsoft actually replaced Money in 2010 with a free version called Money Sunset Deluxe although there’s no Mac version of that either. However, there are plenty of other options for Mac users to manage their finances, from free Cloud based apps to personal finance software designed specifically for Mac. Here then is our list of the best Microsoft Money for Mac alternatives in order of ranking.

1. Personal Capital (Free)

Personal Capital is more than just a way to manage your money, it actually advises you on how to maximize your capital and investments.

Not only that but it’s completely free to use unless you want a personal consultation about how to maximize your investments (which you don’t have to do). It also connects to your bank, credit card, credit union and other financial institutions so that it can automatically download transactions.Personal Capital can also import Microsoft Money files from Windows if they’re in CSV format.

Quicken for Mac 2007. Conversion Instructions. Direct Connect to Web Connect. Northstar Bank. Completes its system conversion to. Independent Bank, you will need to modify your Quicken settings to ensure the smooth transition of your data. Please reference the dates next to each task as this information is time sensitive. Mar 11, 2015 Quicken Personal Finances 2007 for Mac OLD VERSION. The Update Quicken command points to a manual update site. In the end, this is the.only. product for leveraging the tremendous resources Intuit offers in a Mac Native application that comes close to offering a full suite of services to manage personal finances. Quicken for Mac 2007 Conversion Instructions Web Connect Introduction As Chemical Bank completes its system upgrade you will need to modify your Quicken settings to ensure the smooth transition of your data. Please reference the dates next to each task as this. Quicken for Mac 2007 Conversion Instructions Direct Connect to Web Connect. As Wauchula State Bank completes its system conversion to its NEW Online Banking platform, you will need to modify your Quicken settings to ensure the smooth transition of your data. Please reference the. Have used Quicken for over 20 years and like to have a current manual on hand for reference. Have looked high and low for a newer Quicken manual and was unsuccessful. Found the manual on Amazon and did not hesitate to order. Have only skimmed the book since it arrived and appears to be a good reference book for Quicken for Windows. Quicken 2007 for Mac OS X Lion is a re-engineered version of Quicken Mac 2007 that will work on OS X 10.7. This version is ideal for Quicken for Mac customers who use Apple's latest operating system OS X Lion. New Quicken customers should choose Quicken Essentials for Mac to get started. Intended use. Full export of Quicken Mac 2007 (or earlier) data to Quicken Windows. For the most part this is the same as a full export from one data file in Quicken Windows to another new data file in Quicken Windows, and as a matter of fact this is exactly how I’m testing these steps since I don’t have a Mac.

Personal Capital is built around 3 simple pillars: Knowing Your Net Worth, Analyzing & Optimizing Investments and Planning For The Future. This means it gives you a clear overview of your investments and makes recommendations about how you can optimize your finances. The Investment Checkup Tool is one of the best things about Personal Capital as it immediately identifies areas where you should diversify investments without increasing the risk.

Other useful features we really like about Personal Capital include automatic bill reminders, stock value updates and 401K updates.

Although there’s no native Mac client, the web interface works extremely well and Personal Capital looks like an application that’s built for macOS.

If you’re looking for an alternative to MS Money on Mac that not only helps you manage finances but optimize them too, Personal Capital is an excellent free replacement.

You can get started with Personal Capital for free to see for yourself.

You can read our full review of Personal Capital for a more in depth look.

You can also watch a quick overview of all the best features of the application below.

2. Moneyspire

Moneyspire (formerly Fortera Fresh Finance) is an extremely well put together personal finance software that has a native Mac desktop client.

Moneyspire is focused more on managing your day-to-day finances in a straightforward non-nonsense way. One of the big attractions of Moneyspire is that it doesn’t force you to store your financial data online or in the Cloud although you can if you want to enjoy syncing with iOS devices.

Unlike personal finance software such as Quicken for Mac, it also doesn’t tie you into any annual subscriptions to keep using it although again, you can choose that model if you want.

You can also import MS Money files in CSV format into Moneyspire very easily.

For a limited period too, Moneyspire is $29.99 which is 40% off the normal price of $49.99.

The interface of Moneyspire keeps things very simple by not overwhelming you with information – it’s basic but informative with all essential financial data at your fingertips.

Moneyspire can pay bills automatically with the Direct Connect service, generate reports, forecast balances and reconcile accounts.

What we like most about Moneyspire is that it feels like it puts the user first, giving you control over both the storage of your finances and the payment model you prefer. It also doesn’t complicate things unnecessarily with features you’ll probably never need.

Moneyspire is currently $29.99 which is 40% off the normal price of $49.99. You can also try a free trial of Moneyspire to see for yourself.

You can check out our review of Moneyspire for more.

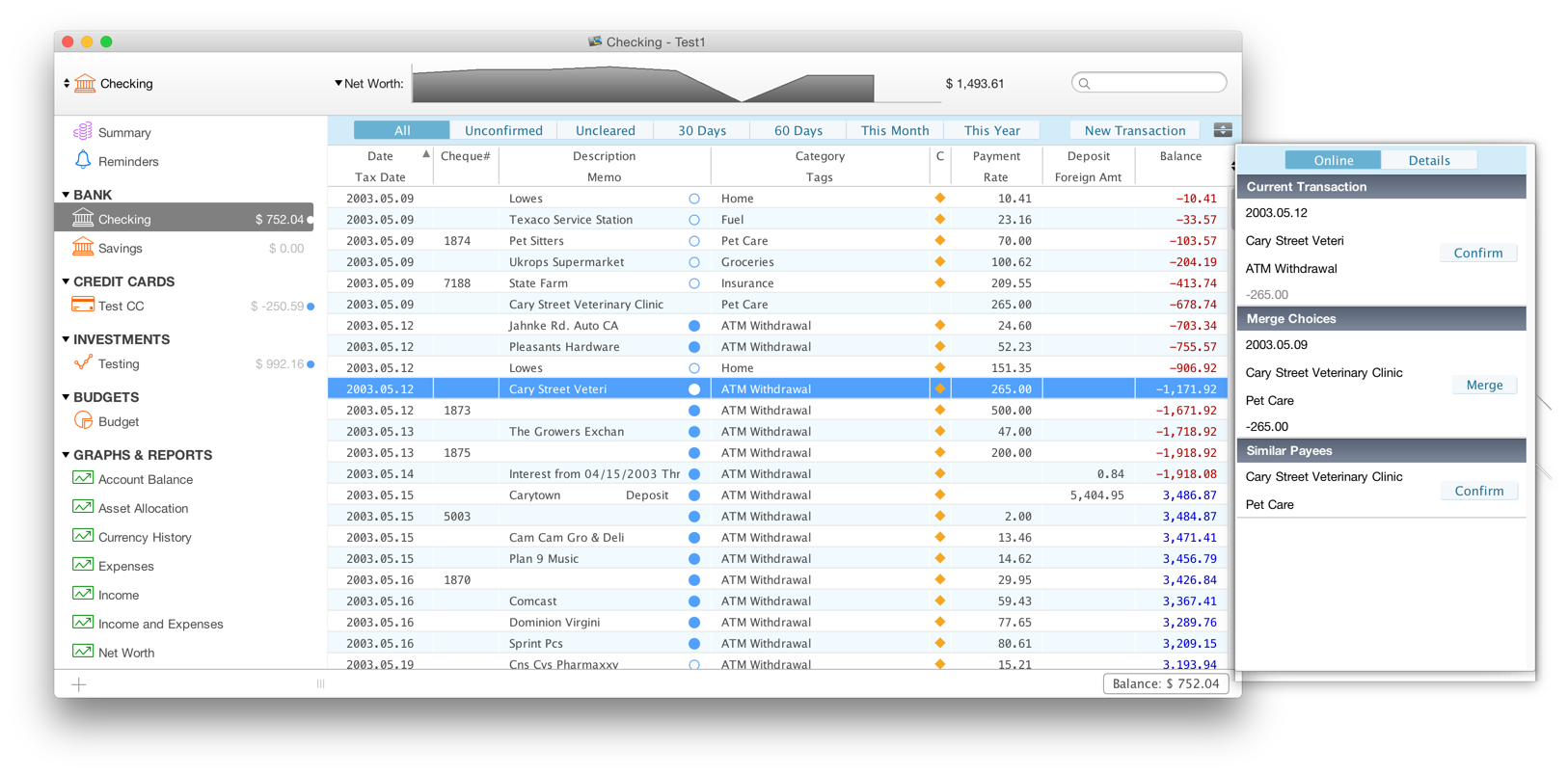

3. Banktivity

Banktivity (formerly iBank) is a popular personal finance application with a desktop app for macOS. In fact Banktivity is designed exclusively for Apple devices and the only budgeting software for Mac which works across Mac, iPad, iPhone and even Apple Watch.

Banktivity can automatically download transactions from your Bank either via its own Direct Access service (although this costs extra) or by using Banktivity’s built-in browser. Banktivity’s Direct Access service supports around 10,000 banks although the reliability of this service often depends on changes your bank makes to security regarding access by third-party apps and type of account. 401K accounts for example are known to be particularly fussy about connectivity with external apps.

Banktivity can track investments, credit cards, savings accounts, mortgages and pretty much most standard types of financial interest you have. You can attach receipts to transactions, print checks and using the Direct Access service, pay bills automatically. You can also generate some quite detailed reports based on your net worth to see exactly where your money is going.

There’s also an iOS app which allows you to track and manage your net worth on the move and syncs with Banktivity’s cloud sync server. Banktivity costs $64.99 but bear in mind if a Direct Access subscription costs an extra $44.99 annually on top although there are also cheaper 90 day or 30 day subscriptions. We recommend trying a 30 day subscription first to ensure that everything works smoothly with your bank.

You can try a free trial of Banktivity to see for yourself.

You can also check out our full review of Banktivity for a more in-depth look.

4. MyMoney

Despite the name, MyMoney is not based on MS Money but has several similarities and features. MyMoney allows you to both import MS Money files and download bank statements. MyMoney then does the hard work for you by automatically entering your statements into an electronic register. The major benefit of MyMoney is that it brings all of your financial data into one place so it’s much easier to track your finances, investments and requires very little manual input. It can even reconcile bank statements and fix any errors it finds. MyMoney generates useful reports and can even do check printing like the old Microsoft Money used to.

On the downside, you may find that you have problems connecting MyMoney to your bank. This is quite a common problem with budgeting software as banks often change security settings and connection protocols from third-party software.

There’s no official list of banks that officially work with MyMoney so we strongly recommend trying the 60 day trial before deciding whether to buy.

5. Quicken For Mac

For many years, Quicken for Mac had a rocky ride with Mac users when it was owned by Intuit but under new ownership, recent versions of Quicken on macOS have been considerable improvements. Quicken is probably the most popular personal finance application out there for Windows users although the Mac version has always lagged behind. Quicken 2018 finally made it comparable with the Windows version although there are various features it still lacks and it’s not exactly the same product.

One of the biggest recent improvements to Quicken For Mac has been the introduction of Bill Pay so that you can automatically manage and pay bills online. Reporting has also been improved although it is still behind the Windows version of Quicken. The overall interface and speed has been improved to make it more similar to the Windows version too. Most controversial of all however was the decision to make Quicken For Mac 2018 subscription only. Quicken users on both Windows and Mac can no longer pay a onetime fee, you must pay an annual subscription to maintain online services such as Bill Pay. If you don’t renew your subscription, you can still edit your accounts on your Mac desktop as long as you’re not using the Starter Edition in which case your accounts will be read-only.

If you’re interested in learning more, you should check out our review of Quicken 2018 for Mac.

These are the best equivalents to Microsoft Money on Mac we’ve found. If you have any questions, comments or experiences you want to share with any of the software featured here, let us know in the comments below.

You May Also Like:

Web Connect

As 1st United Services Credit Union completes its system conversion, you will need to modify your Quicken settings to ensure the smooth transition of your data. Please reference the dates next to each task as this information is time sensitive.

To complete these instructions, you will need your User ID and Password for each Financial Institution.

You should perform the following instructions exactly as described and in the order presented. If you do not, your online banking connectivity may stop functioning properly. This conversion should take 15-30 minutes.

Thank you for making these important changes!

1. Backup your data file. For instructions to back up your data file, choose Help menu > Search. Search for Backing Up, select 'Backing Up Your Data,' and follow the instructions.

2. Download the latest Quicken Update. For instructions to download an update, choose Help menu > Search. Search for Updates, select 'Checking for Updates to Quicken,' and follow the instructions.

Task 2: Disconnect Accounts at1st United Services Credit Union on or after 4/11/2017

2. Select the account to deactivate and click Edit.

3. In the Download Transactions drop-down list, select Not Enabled. Follow the prompts to confirm the deactivation.

4. Remove the information within the Account Number and Routing Number fields.

5. Click OK to save your edits.

Quicken 2007 Download

6. Repeat steps 2 - 5 for each account to be disconnected.

7. Verify your account list does not display a blue online circle icon for the accounts you are disconnecting.

Task 3: Connect Accounts at1st United Services Credit Union on or after 4/11/2017

1. Download your Quicken Web Connect file from 1stunitedcu.org.

Quicken For Mac 2007 Manual Download

NOTE: Take note of the date you last had a successful connection. If you have overlapping dates in the Web Connect import, you may end up with duplicate transactions.

2. Import your transactions to Quicken.

3. Associate the account to the appropriate account already listed in Quicken. Select Use an existing account.

4. Match the transactions you are importing to the corresponding existing Quicken account in the drop-down list and click OK.

5. Repeat steps for each account to be reconnected.

Financial Software For Mac

6. Choose Lists menu > Accounts. Verify each account at 1st United Services Credit Union has a blue online circle indicating it has been reactivated for online services.